Africa New and Changed Reports

When you run the IPR Tax Certificate report in a company using tax methods instead of Africa Rule Linking, an error is generated indicating that there are no transactions to report on.

The reason for this issue was that the report used the Tax Rebate amount as calculated on the employee’s Tax Screen. For companies making use of tax methods, this field is not available.

To resolve this issue, we added a new Report Selection field for the Tax Rebate.

This selection is only applicable to Tax Method companies.

You must link the relevant XS Line used to calculate the YTD+ Tax Rebate Amount. This value will be printed on the Tax Certificate if you are using a Tax Method company and will also resolve the report error.

For companies using Africa Rule Linking, no linking is required, and the Tax Rebate Amount will still be populated from the employee’s Tax Screen.

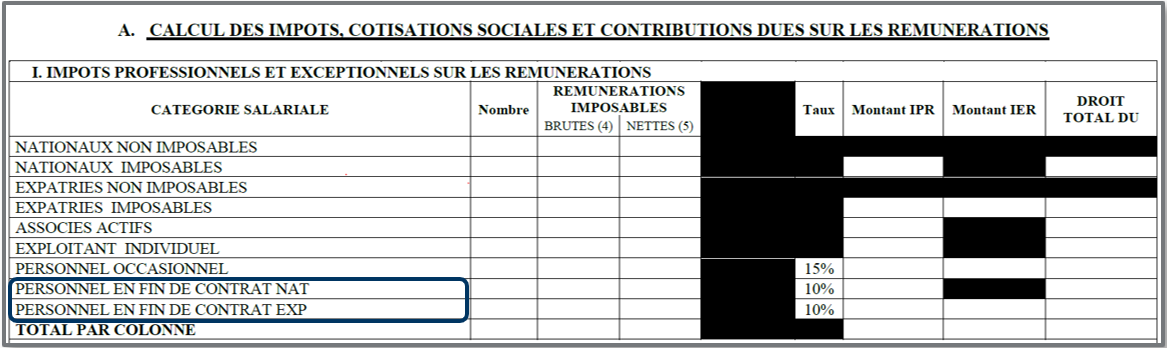

The layout of the DRC Statutory Contributions Report (Déclaration Mensuelle Unique des Impôts) has been updated as per the latest requirements. The changes include the following:

- There are many cosmetic changes such as new logo for CNSS, some abbreviations are now shown in full, some fields are renamed but the content remains the same. Some headings have changed but the meaning remains the same.

- Part C is totally removed. Part D is renamed to Part C.

- The Provinces remained the same but some have been renamed to show their full names.

|

Previous Description |

New Description |

|---|---|

|

BAS-CONGO |

KONGO-CENTRAL |

|

NORD-KIVU |

NORD KIVU |

|

ORIENTALE |

P. ORIENTALE |

|

SUD-KIVU |

SUD KIVU |

You have to amend the Province descriptions in the appropriate payroll field to match the descriptions on Part C:

Main Menu > Payroll > Definitions > System Description Codes

> Select the applicable Analysis Field you are using for Provinces

If you skip this step, you will not be able to print the report.

NB: The Provinces must be recorded as stated below, in CAPITAL letters.

The complete list is as follows:

|

Province Descriptions |

Province Descriptions |

Province Descriptions |

|---|---|---|

|

KINSHASA |

KASAI OCCIDENTAL |

KONGO-CENTRAL |

|

BANDUNDU |

KASAI ORIENTAL |

NORD KIVU |

|

EQUATEUR |

MANIEMA |

P. ORIENTALE |

|

KATANGA |

SUD KIVU |

|

- Extra columns have been added on Part A in the CNSS section.

- Contribution Rates in Part A have been updated.

- In Part A the Occupational Risk category of the CNSS is split between normal professional employees and assimilated employees

In addition to above mentioned changes, we also had to make the following change to the report:

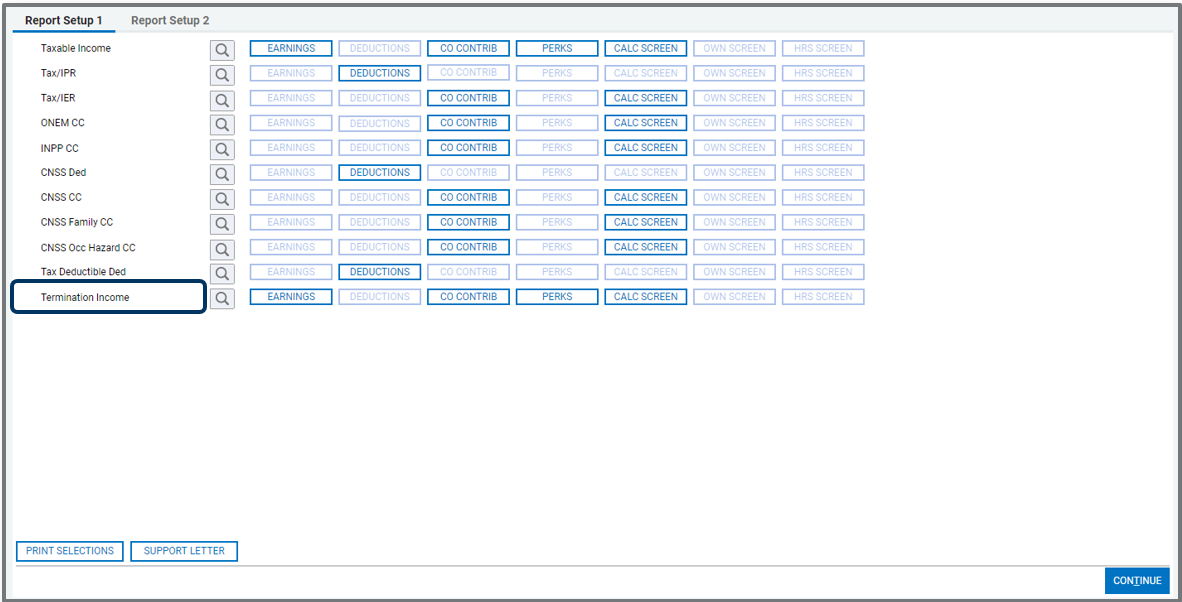

- In Section I, fields ‘Personnel En Fin de Contract Nat’ and ‘Personnel En Fin de Contract Exp’: The values required for these fields are for employees who received termination income taxed at a fixed rate of 10%.

- A Report Selection has been added for ‘Termination Income’: Please ensure that you link all earning definitions that are used for income that is taxed at the fixed rate of 10%.

- For the rest of the fields, only employees with Taxable Income must be included. Please make ensure that you exclude Termination Income Earning Definitions from the ‘Taxable Income’ Report Selection.

If an employee has Normal Taxable Income and Termination Income, the employee will be included and counted twice, e.g. the employee is a Congolese National, tax was deducted from the employee, the employee is terminated in the reporting month and received both Normal Taxable Income and Termination Taxable Income – this employee will, therefore, be included in both the sections for ‘Nationaux Imposables’ and ‘Personnel En Fin de Contract Nat’.

The following issues have been resolved or the changes have been made to existing reports:

|

Country |

Report |

Detail |

|---|---|---|

|

DRC |

Various Reports |

The following DRC Statutory Reports have been removed from the DRC Report Menu as these reports are no longer required by the authorities:

|

|

DRC |

IPR Tax Certificate Report |

Family Allowance is not a mandatory earning anymore and is not required to be reported on separately. The Report Selection for Family Allowance has been removed and the field for Family Allowance on the report is populated with a value of 0.00 Note: Please ensure that you re-link the Family Allowance Earning Definitions to the Taxable Income Report Selection to ensure this value is still included in the Employee’s Taxable Remuneration. |

|

Kenya |

P10 iTax Report |

Updated the report with the new maximum limit for HOSP – was 4 000.00 and is now 8 000.00 |

|

Kenya |

P9 Tax Deduction Card Report |

Updated the report with the new maximum limit for HOSP – was 4 000.00 and is now 8 000.00 |

|

Swaziland |

PAYE05 Tax Certificate Report |

The Company Tax Number was not printing on the Official Stationery option. This issue has been resolved. |

|

Zambia |

P13 Employee Leaving Report |

When an employee was terminated with a future termination date, the ‘Total Pay’ amount was incorrect. This issue has been resolved. |

|

Zimbabwe |

P2 Remittance of PAYE Return |

The headcount on the report was printing the incorrect number of employees. This issue has been resolved. |

The following change to an existing bank file has been added to the system:

|

Country |

Bank File |

Detail |

|---|---|---|

|

Zambia |

Barclays Bank File |

The Company Bank Code was not populating the required field in the bank file’s debit detail record. This issue has been resolved. |